Private Equity Demand Continues to Drive Attractive Sale Prices

GB Auto Service, Inc., a Greenbriar Equity Group, L.P. holding, has made a move to expand its presence nationwide. GB Auto Service underwent an acquisition at the beginning of April 2021 to take control of Goodguys Tires & Auto Repair, a five-location automotive repair and service chain that has operated across northern California since 1976. Goodguys Tires & Auto Repair’s President, Scott Shubin, is excited for the transition to GB Auto Service’s ownership, saying, “[It] will help fuel the growth of our brand, while strengthening the uncompromisingly exceptional service that our customers have come to rely on over these past four-decades plus.” GB’s automotive repair brand has been active in the acquiring repair companies nationwide. They completed the acquisition of three Houston-area automotive stores in December 2020, as well as three more acquisitions in Texas, Oklahoma, and Arizona in August 2020. The purpose of this acquisition is to grow GB Auto’s presence across the nation, but also to broaden their footprint in California.

High demand from private equity groups and strategic buyers have been driving attractive prices for sellers.

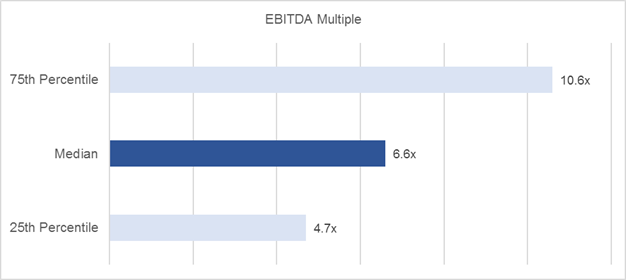

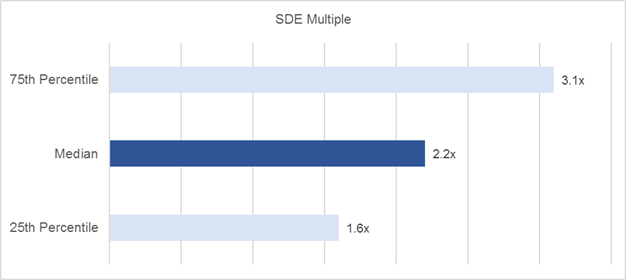

Precedent Comparable Transactions: Automotive Repair Industry

Middle Market companies (above $5,000,000 in revenue) in the Automotive Repair industry (SIC 7532, 7533, 7534, 7537, 7538, and 7539) had an EBITDA2 Median Multiple of 6.6x, based on 11 transactions between 2010 and 2021.

Main Street companies (below $5,000,000 in revenue) in the Precision Manufacturing industry (SIC 7532, 7533, 7534, 7537, 7538, and 7539) had a SDE1 Median Multiple of 2.2x, based on 228 transactions between 2015 and 2021.

If you’re contemplating a sale of your automotive repair company or simply would like to understand your options, contact a Sunbelt Advisor today. We have closed multiple strategic and financial transactions in the automotive industry and have industry specialists ready to answer any of your questions.

We also offer a no-obligation, complimentary value range for your company.

1Seller’s Discretionary Earnings – Seller’s discretionary earnings is defined as net profit before taxes and any compensation to owner plus amortization, depreciation, interest, other non-cash expense and non-business-related expense and normally to one working owner. (Source: BV Market Data)

2Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) – EBITDA is Net Income with interest, taxes, depreciation, and amortization added back to it. EBITDA can be used to analyze and compare profitability between companies and industries because it eliminates the effects of financing and accounting decisions. However, this is a non-GAAP measure that allows a greater amount of discretion as to what is (and is not) included in the calculation. This also means that companies often change the items included in their EBITDA calculation from one reporting period to the next. (Source: BV Market Data)