Private Equity Acquires Managed IT

Ensono found its new owner in April 2021, when the private equity mega-group, KKR & Co., signed a definitive purchase agreement to acquire the worldwide IT services giant. Ensono is based in Downers Grove, Illinois, and the company is widely regarded for providing services to aid clients with IT infrastructure and digital transformation projects. Ensono designs, builds, and optimizes services for clients across mainframe, midrange system, private cloud, and public cloud infrastructures. Private equity groups, such as KKR, are constantly searching for strong technology and technology services companies to add to their core portfolios. Jeff VonDeylen, Ensono’s CEO, remarked, “They [KKR] are seeing companies move to the cloud, and seeing companies like ours helping those companies succeed not only with the new shiny stuff but with legacy technology.” IT services companies continue to be strong acquisitions for private equity groups, and their services are widely applicable throughout portfolio companies. Acquiring a managed IT firm can improve portfolios, but it can also improve the individual companies within the portfolios if allowed to work with other companies.

High demand from private equity groups and strategic buyers have been driving attractive prices for sellers in this roaring industry.

Precedent Comparable Transactions: Managed IT Industry

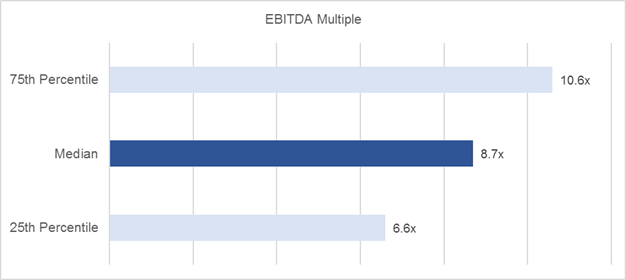

Middle Market companies (above $5,000,000 in revenue) in the Managed IT industry (SIC 7374, 7376, 7378, and 7379) had an EBITDA2 Median Multiple of 8.7x, based on 16 transactions between 2011 and 2021.

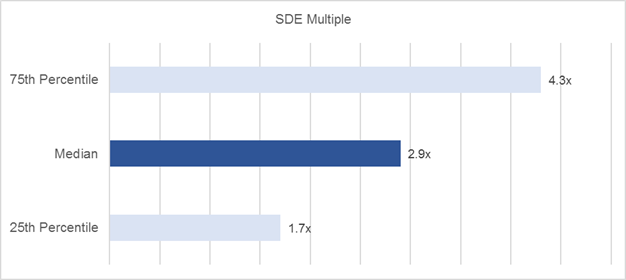

Main Street companies (below $5,000,000 in revenue) in the Managed IT industry (SIC 7374, 7376, 7378, and 7379) had a SDE1 Median Multiple of 2.9x, based on 42 transactions between 2011 and 2021.

If you’re contemplating a sale of your managed IT company or simply would like to understand your options, contact a Sunbelt Advisor today. We have closed multiple strategic and financial transactions in the managed IT industry and have industry specialists ready to answer any of your questions.

We also offer a no-obligation, complimentary value range for your company.

1Seller’s Discretionary Earnings – Seller’s discretionary earnings is defined as net profit before taxes and any compensation to owner plus amortization, depreciation, interest, other non-cash expense and non-business-related expense and normally to one working owner. (Source: BV Market Data)

2Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) – EBITDA is Net Income with interest, taxes, depreciation, and amortization added back to it. EBITDA can be used to analyze and compare profitability between companies and industries because it eliminates the effects of financing and accounting decisions. However, this is a non-GAAP measure that allows a greater amount of discretion as to what is (and is not) included in the calculation. This also means that companies often change the items included in their EBITDA calculation from one reporting period to the next. (Source: BV Market Data)